JIT Funding for Crypto Payouts with Virtual Cards.

This article is made for anyone in the payments (payouts) space, but especially for those in the crypto payments space. I will describe in detail what I believe to be one of the most elegant ways to utilize Virtual Cards.

First of all, what is JIT?

Ok, that last paragraph isn’t readable so let’s do it with an example. Let’s say, YOU are the owner of XYZ company that allows its users to send their crypto to your wallets and use it in the real world. You want to authorize our users to go to the grocery store and use the crypto in their wallet to buy a banana. The goal is simple and clear. Now to the solution.

The Problem: You can’t buy a banana🍌

If like me you lack some creativity and can’t think of the said downsides, here is the quick list of the key issues with prepaid debit cards💳:

-

Virtually a fund float (simplified definition: the time where funds are in between accounts and do nothing). The $100 you’ve just sent to the user is just sitting on the card doing nothing and can be viewed as the fund float. These funds are sitting there generating no revenue for you or your customer. While $100 isn’t much, when you have 10,000 customers this float adds up.

-

Unused funds are a pain. The user is quite efficient and manages to spend $99 from that card. $1 is gone OR you are using a system like Checkbook that will allow you to withdraw unused funds back to the users’ account, but that’s a whole other system for you to build out + an additional expense on the pull transaction.

-

Limited visibility. Once you fund the card, that’s all you get in terms of data. You have no idea what the user bought, when, and for how much. You don’t even know if the user actually used the money that was on the card until the card expiry date.

Lacking creativity myself, those are the key downsides that I could think of, but even one of those bullet points is plenty to hate on pre-funded debit cards. As you can tell, I managed to come up with 3. Bigger minds can pull more, but here we are - hating on prepaid debit cards together because of the 3 bullet points.

Solution to the problem:

YOU are still the owner of XYZ company and your user still wants to buy a banana. But now you know about JIT so instead of issuing your user a prepaid debit card and hoping for the best, you issue them an empty virtual card when they are onboard to your platform. WHAT? Yes, there is $0 on that debit card but don’t fret, your user can still buy that banana. There is one more step before we get to that though - a setup of JIT funding itself. Not for the user, but for you.

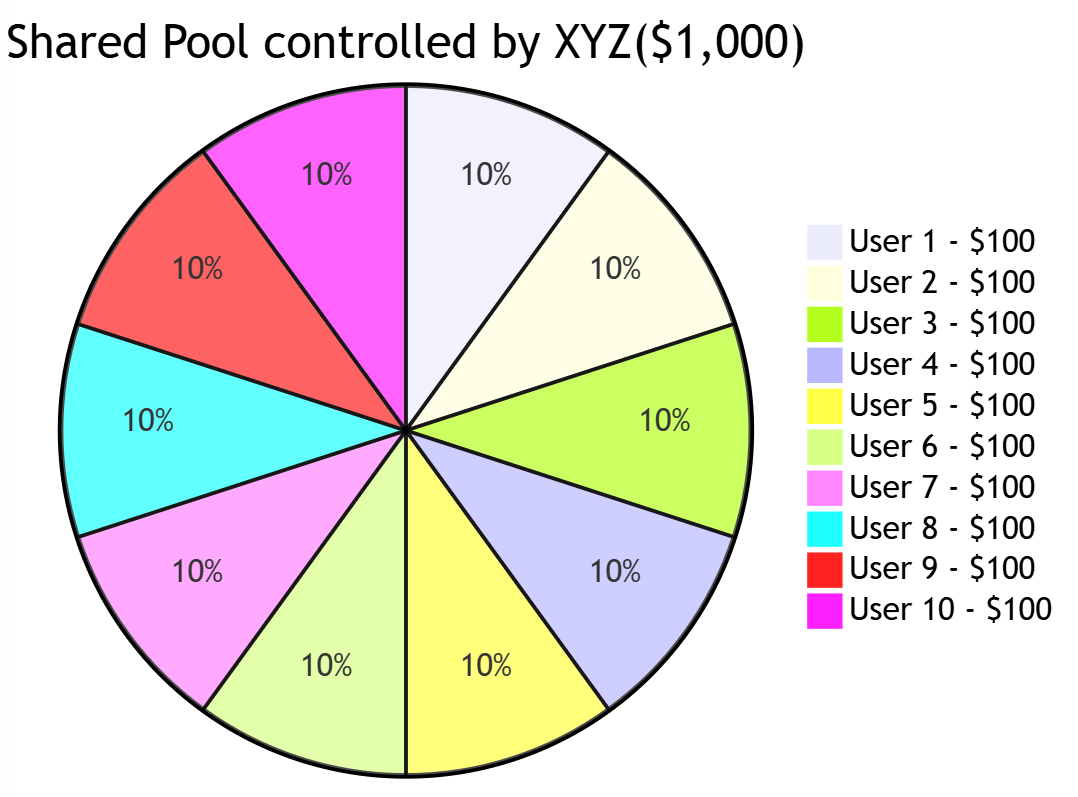

What you need to do is create a pool of funds that is stored at some payment facilitator who can provide you the JIT funding option for the virtual card. It means storing funds at a custodial account shared between you, the payment facilitator, and your clients. Within that pool we build an internal ledgering system that tells us who owns what part of the pool. So you might have a total of $1,000 sitting in the pool with $100 belonging to each of your 10 users. Now we’re getting to the fun part of finally purchasing the banana.

Buying the Banana.🤑

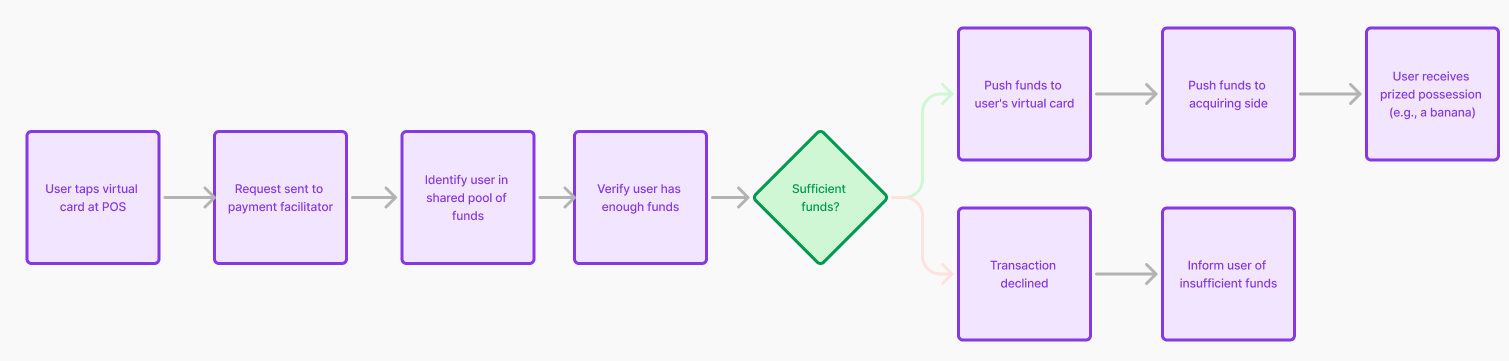

That 2-3 second delay you get at the checkout? That’s the systems communicating all this information to each other. Once the systems finish talking to each other and pushing the funds, your user might finally get their prized possession (a banana home).

On a more serious note, here is the flow chart of how this process looks like:

After this transaction is complete, the internal ledgering of the shared pool of funds will reflect the amount that any given user spent and that will be the end of it (at least for you and the user). The rest of the work is done on the acquiring side (the store) and I won’t get into it in this post.

Wrapping it all up.🌯

Now, let’s summarize some of the key benefits of JIT funding as a payout option through virtual cards. Here they come:

-

Increased cash availability. Although you need to store at least some funds in the shared pool to cover the incoming transactions, you can share the funds between the users, front the funds to the user and keep the rest of the funds elsewhere. You could be generating interest from just holding the funds, you could be investing them as part of your business model, you could do anything else with those funds that are now free thanks to JIT funding. Just get creative!

-

No unused funds. Your user has $0 on their virtual card, remember? That means you’ll never get into a situation where your user has $4 just stuck on their card because they can’t find anywhere to spend it.

-

You have visibility. I mean, this one is self explanatory - the JIT funding requests come to your system after your user tries to buy anything. You know when, where, what, who, and for how much. Doesn’t get better than this.

-

With visibility comes control (in a non-threatening way). You could decide what MCCs to ban. For example, you might want to allow your users only to spend their money on food, gas, and other travel-related expenses. With JIT funding - you can! It also protects you from your user potentially interacting with unwanted industries like adult content, gambling, CBD/THC purchases, etc.

-

Even more control. Once you issue a prepaid debit card - that’s it, the funds are stuck there unless you go through the hoops. If that card is stolen, the funds are also gone. With JIT-funded virtual cards you can issue new cards whenever you please. The user reports it stolen? Freeze it in the next 0.1 second and issue a new card in another 0.1 second. That thief will be stuck with an inactive virtual card that has $0 on it.

Once again, my creativity is limited and big-brained individuals could think more but I hope that I have conveyed the message well enough. Now, with a total of 8 bullet points, I hope to have inspired at least a few hundred of you who will actively make fun of prepaid debit cards. At this day and age, they are only suitable for gifts to your estranged 15-year-old nephew and not actual payouts.

If you want to join me in praising JIT funding and implement a solution like that for your own XYZ organization to allow your user to buy that damn banana - shoot me an email: kdubovitskiy@checkbook.io

And of course, if you have money to move (even if not through JIT-funded virtual cards), I’ll be happy to talk about it.

Don’t forget to check out our substack where this post was originally published: https://aftfinance.substack.com/

P.S. I strongly believe that AI should only be used to replace human labor that isn’t enjoyable by humans and not in content creation. That being said, AI wrote exactly 0% of this post. I hope my hUMaN WrITinG stYle isn’t repulsive.

P.S. 2. Although Checkbook is mentioned a handful of times, this is not a sponsored post. Unlike Fundraising Radio, AFT Podcast and AFT Publishing are very much for-profit but I will continue the tradition of notifying all my readers and listeners if the content they’re consuming is sponsored.